The tokenization of traditional finance is back in the news, as suits in boardrooms across the United States are discussing the benefits and risks of integrating cryptocurrency into their business. The term “tokenization” refers to deploying traditional financial assets on cryptocurrency rails, digitizing analog financial assets (including currency), and thus enable the financial industry to benefit from the speed and transparency that blockchains provide. But is this another crypto fad, or is there a fundamental problem that the young industry is addressing for the legacy financial world?

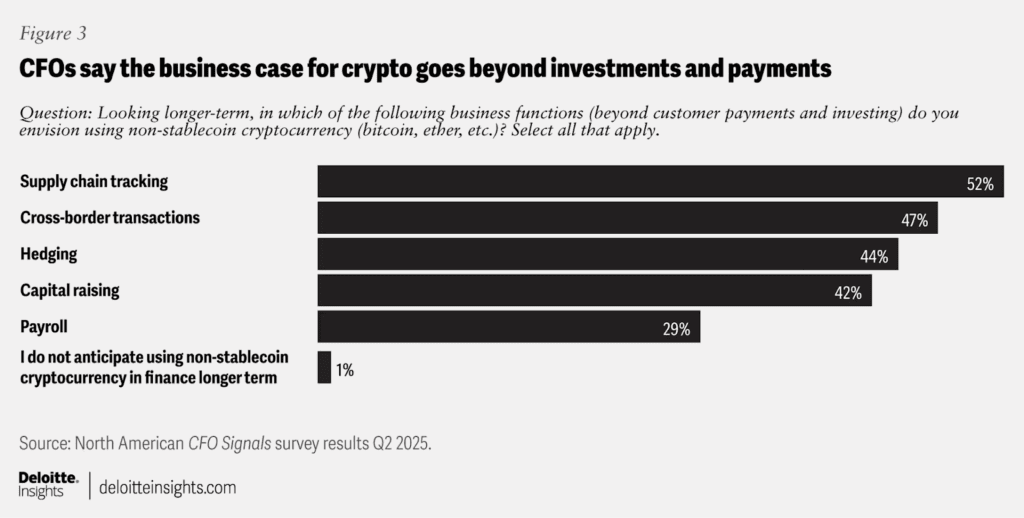

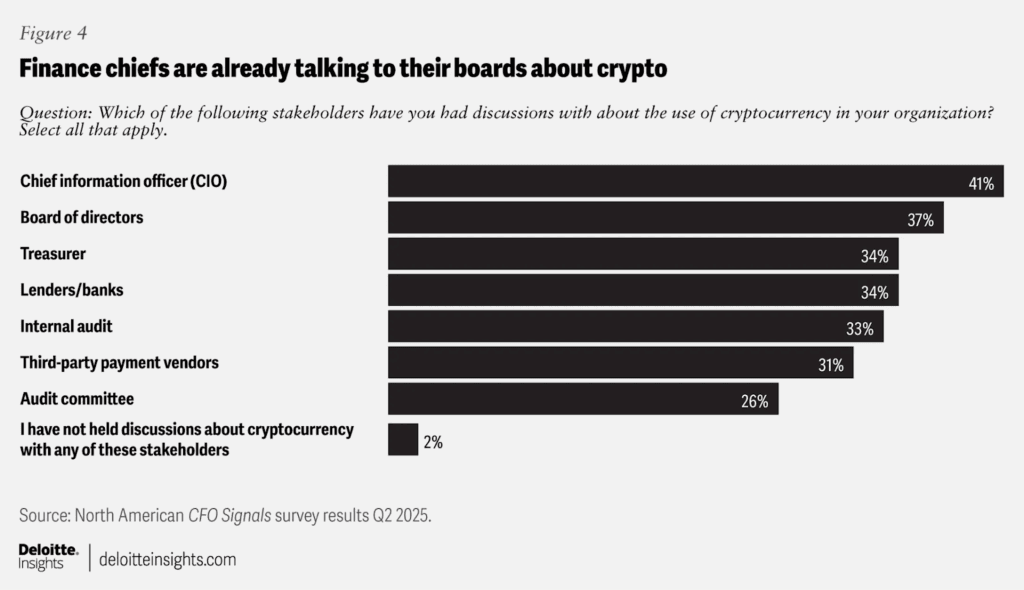

A Deloitte survey published in July polled 200 Chief Financial Officers working at companies with at least US$1 billion in revenues on the topic of tokenization. The survey showed that almost all CFOs expect their business to use “cryptocurrencies for business functions in the long term.” Only 1% of those polled said they did not envision it. And 23% said their treasury departments “will utilize crypto for either investments or payments within the next two years,” a percentage which is closer to 40% for CFOs at organizations with US$10 billion in revenues or more. Also, of those surveyed, only “2% of respondents said they have not had any conversations about cryptocurrency with key stakeholders”.

Tim Davis, a Principal at Deloitte told Bitcoin Magazine that there are two narratives making their way through American finance, “one is whether to have Bitcoin on the balance sheet and the other is a broader appreciation of tokenization’s future, which seems increasingly inevitable.” He added that “the first step is often stablecoins—how to adopt them, whether to issue their own coin. More corporates are having this broader strategy conversation today than those committing to Bitcoin on the balance sheet.”

Stablecoins in particular have captured Wall Street and Washington’s interest, as a tool that can serve the interests of the United States both at home and abroad. The survey reinforced this growing trend, showing that fifteen percent of CFOs expect their organizations to accept stablecoins as payment within the next two years, a percentage that is “higher (24%) for organizations with at least US$10 billion in revenue.”

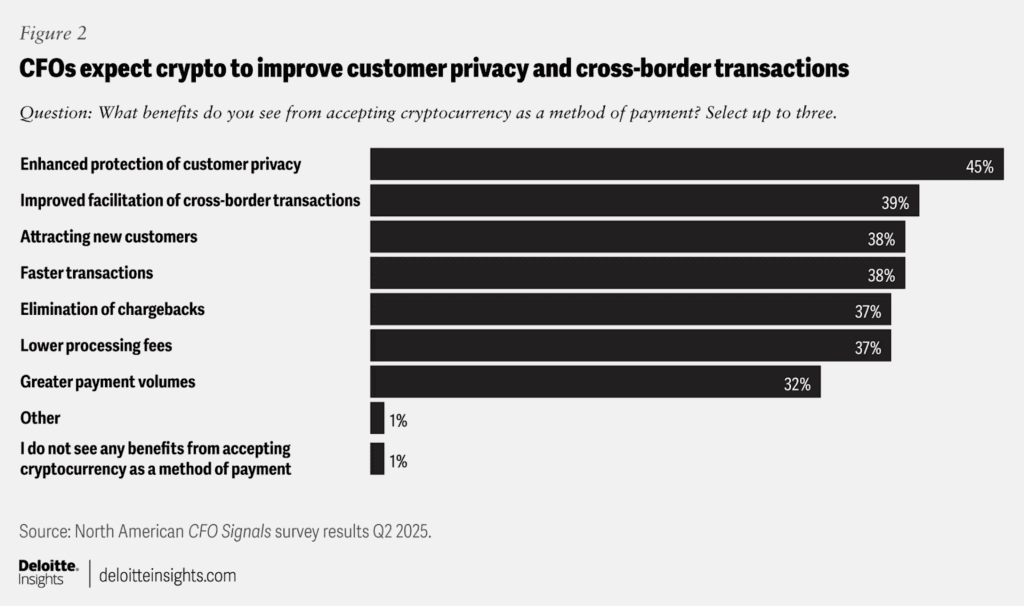

When asked about the benefits of “accepting cryptocurrency as a method of payment”, CFOs cited enhanced customer privacy as the most valuable _____, recognizing the massive damage done to user privacy by legacy know-your-customer (KYC) style data collection laws, and their unintended consequences in the digital age.

Step by step, the Bitcoin and crypto industry is merging with traditional finance, and the consequences are more profound than most people think. Terms like “tokenization” and “real world assets” or RWAs are often said in the same breath, almost treated as synonyms. But what does “tokenization” really mean for Wall Street and CFOs across America, and why are they so intrigued by it?

Davis says stablecoins and real-world asset tokenization are not about being trendy, reaching younger customers, or expanding into foreign markets, but they are about upgrading fundamental layers of the financial infrastructure, with new qualities like higher velocity of money, more privacy for users, while also increasing transparency and real-time data about transactions across the market.

Satoshi Nakamoto on the Problems with Traditional Finance

The curiosity shown by CFOs regarding the “tokenization” of finance is a topic Bitcoiners might be underappreciating and misunderstanding. In fact, the problems that traditional finance (TradFi) looks to solve with ‘tokenization’, might not be too far from those Satoshi Nakamoto identified and sought to address in his original Bitcoin white paper — the technical document that gave birth to Bitcoin and the modern cryptocurrency industry.

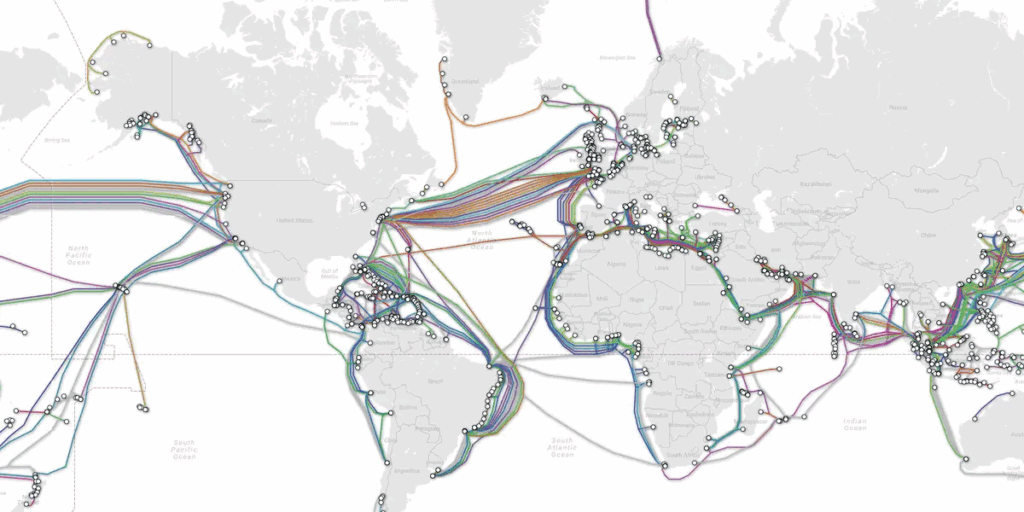

This quote strikes at the heart of the matter. The technology that underpins TradFi was thought out before the invention of the internet. Before computers orders of magnitude more powerful than the Apollo II were in the pockets of over half of the world’s population, before internet fiber lines thick as whales were rolled out across the ocean sea beds to connect the world, before lower orbit satellites decorated the night sky, raining information down to home antennas and back, as if a new constellation had entered the pantheon, born of man’s envy of the Gods.

Before all that, the brick-and-mortar, high-trust, international banking club made sense. But in the dawn of the digital age, a lot of the old ways of doing business can benefit from a shift; Bitcoin invites them to evolve.

So, perhaps Wall Street’s interest in tokenization isn’t just a fad. Davis explained that “it’s not about onboarding younger generations or expanding outside of the U.S., it’s about transforming how business is done today using tokenized blockchain rails, and there’s increasing appreciation for how existing rails can be improved.”

The upside to upgrading financial infrastructure “is huge,” Davis added. “Short-term implications include increased velocity of money. Faster trade settlement and global money movement. It frees up capital held in inefficient systems.”

Blockchains have already transformed trading schedules throughout the world, as they function 24/7, which is not the case in TradFi, Davis noted.

“If you’re a bank, you basically have to pre-fund these payment channels,” he explained.

“Let’s say you’re expecting about $100 million of movement in a day in a certain channel, you have to fund that to the extent of 120% just in case. So, you’ve got over time $20 million of dead money that is sitting there, but doesn’t need to sit there. It’s not only increasing the speed, you’re also freeing up money that’s otherwise trapped in an archaic system”.

Diving deeper into how trades get settled in tradFi today, Davis explained that “the SEC has long had this program in place to accelerate the timeline through which securities trades get settled.”

“Today we’re working on a T+1 mandate, adding a day of delay to settle a trade. But increasingly — and it’s really been with the shift in the administration in the White House — there’s this realization that we do need to be looking more seriously at blockchain rails, if we’re ever going to get to this T+0, which is the settlement of transactions within the same day, ideally in hours, if not minutes,” he added.

On the policy front, Davis highlighted that “there is a very concerted shift going on from regulators, these financial intermediaries that work on these kinds of settlements as well as all the arms of government to push the way that our financial markets work, to realize the benefits of this new technology.” The benefits to the economy as a whole would be significant, Davis told Bitcoin Magazine that under this new paradigm it “becomes dramatically more efficient for companies and individuals to manage their money and their positions — be it stocks, bonds, or real estate.” It would allow people to make important financial decisions “without needing a lot of these archaic systems that add cost and in some cases even add risk,” Davis added.

Why Satoshi Nakamoto Chose Proof of Work

There’s one main problem with the blockchain and tokenization coming from Wall Street, and that is that most blockchains are simply not secure at the consensus level. In order to achieve high levels of transaction speed and throughput, many cryptocurrency projects put the CPU and memory burdens of running blockchain infrastructure on professional ‘node runners’ raising the costs infrastructure dramatically. This is in contrast to Bitcoin’s layered approach, which keeps layer one small and easy for anyone to run a copy of, while settling high speed payments on the Lightning Network.

In order to skip the slow and risky build-up of a proof of work mining community, many cryptocurrency projects launch these networks as proof of stake protocols instead, which has coin holders vote on consensus decisions with their balance, instead of mining. These votes represent power on the network, and can decide things such as which transactions make it into the blockchain, and even reverse transactions altogether. The result is yet again a trusted system that, while possibly more efficient and fraud-proof than TradFi, nevertheless starts centralized and could stay that way, making it potentially vulnerable to litigation.

Satoshi Nakamoto understood the added costs and systemic risks of trust-based settlement systems deeply, which is why he chose proof of work as Bitcoin’s consensus protocol. “Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs — with the possibility of reversal, the need for trust spreads,” he wrote in the first paragraph of the Bitcoin white paper.

“Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party,” he added.

While Wall Street will likely ignore Bitcoin as the superior blockchain on top of which to build out its tokenization and settlement plans, if the consensus layer matters at all, they will eventually learn the hard way, through litigation and disputes, that having finality — or as bitcoiners call it, immutability — has its benefits. Those who start building on Bitcoin now will probably have an edge.