Momentum Builds Toward $98,000 Amid Neutral Mood

After remaining relatively sideways through the Christmas and New Year’s weeks, the bitcoin price made a small move higher over this past weekend. Bitcoin price closed the week at $91,489,

After remaining relatively sideways through the Christmas and New Year’s weeks, the bitcoin price made a small move higher over this past weekend. Bitcoin price closed the week at $91,489,

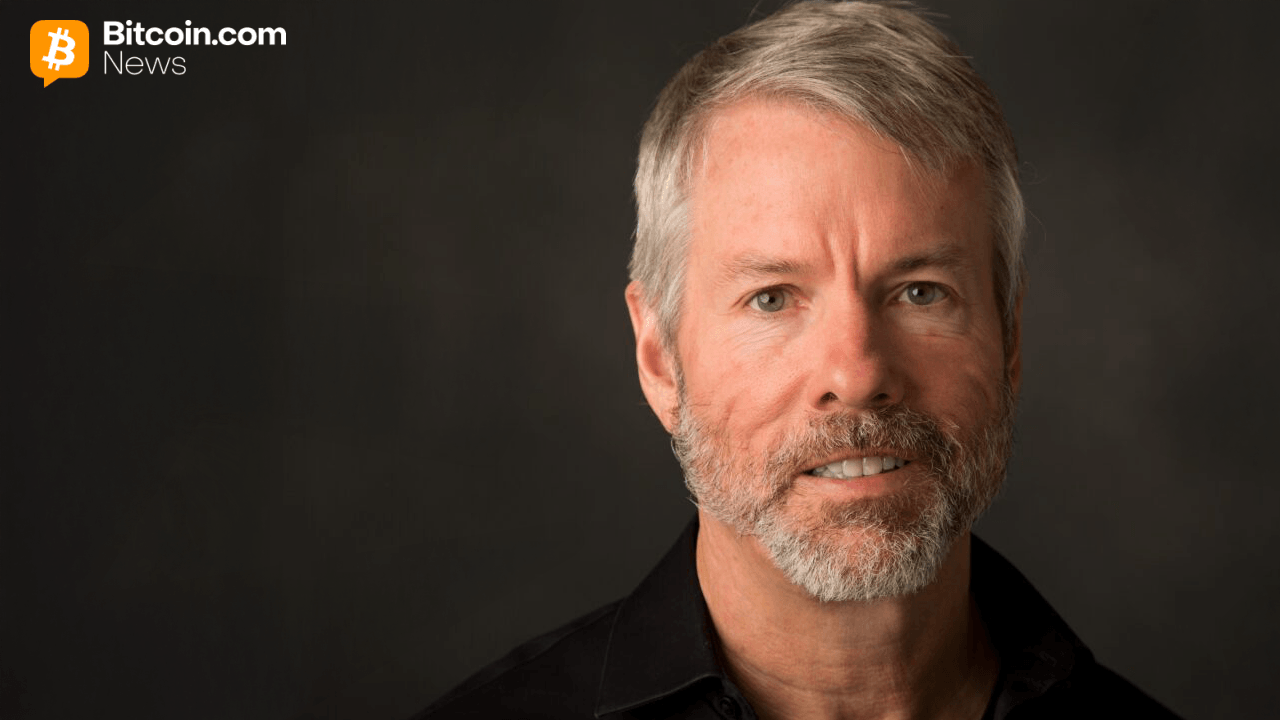

On Monday, Strategy founder Michael Saylor revealed his firm had snapped up more bitcoin for the vault. The latest haul totaled 1,287 BTC, lifting the company’s stockpile to a tidy

Cryptocurrency hardware wallet provider Ledger has clarified a recent data incident involving its e-commerce partner Global-e. Global-e, a cross-border e-commerce platform integrated by Ledger in October 2023, experienced unauthorized access

More than $5.5 billion in cryptocurrencies are scheduled to unlock in January, with ONDO, BGB, HYPE, and TRUMP tokens accounting for some of the largest releases this month. According to

PWC’s U.S. leader says the firm is now actively expanding crypto services following recent pro‑digital‑asset regulations. Paul Griggs, U.S. senior partner of Pricewaterhousecoopers (PWC), told the Financial Times that the firm

Stablecoin transfer volume on Ethereum surpassed $8 trillion in the fourth quarter of 2025, marking a new all-time high, Token Terminal reported on Monday. The $8 trillion milestone is almost

A bold forecast calls for silver to open tomorrow at $100 and surge to all-time highs as momentum builds across hard assets, according to Rich Dad Poor Dad author Robert

Welcome to Latam Insights, a compilation of the most relevant crypto news from Latin America over the past week. In this week’s edition, Polymarket traders win big on Maduro’s downfall,

The CoinMarketCap “Crypto Fear and Greed Index,” a metric tracking crypto investor sentiment, flipped to “neutral” on Sunday, for the first time since October, signaling that investor sentiment is improving.

Bitcoin (BTC) near year-to-date highs into Sunday’s weekly close as traders braced for liquidity grabs. Key points: Bitcoin enters classic fakeout territory as the weekly close coincides with the aftermath