Amid a wave of panic in crypto markets, rumors surfaced Friday that Strategy (MSTR) was selling its bitcoin holdings as both BTC and MSTR stock tumbled.

Executive Chairman Michael Saylor quickly dismissed the chatter, telling CNBC, “We are buying bitcoin,” and promising that the company’s next purchases will be reported Monday. He added that Strategy is “accelerating [its] purchases” and suggested investors could be “pleasantly surprised” by recent activity.

The rumors stemmed from on-chain movements showing BTC leaving company-controlled wallets, coinciding with a brief drop in bitcoin below $95,000, its lowest level in roughly six months.

Saylor, however, maintained confidence, saying, “There is no truth to this rumor.”

MSTR shares fell under $200 in pre-market and early trading, down nearly 35% year-to-date, prompting concerns that the company might liquidate bitcoin to stabilize its balance sheet.

Saylor advised investors to maintain perspective amid the volatility. “Zoom out,” he said, noting that bitcoin was trading in the $55,000-$65,000 range just over a year ago. Even after recent declines, BTC at $95,000 “is still showing a pretty great return.”

He added that Strategy has “put in a pretty strong base of support around here” and expressed comfort that bitcoin could rally from current levels.

Strategy now holds more than 641,000 BTC, valued at roughly $22.5 billion, with an average purchase price of around $74,000 per coin. The company’s market capitalization has fallen below the value of its bitcoin holdings, pushing its market-to-net-asset value (mNAV) below 1, a metric often cited as evidence that the stock may be undervalued.

Despite these numbers, Saylor emphasized that Strategy’s balance sheet is “pretty stable” and only fractionally levered, with no imminent debt trigger points.

Bitcoin is always a good investment

On long-term prospects, Saylor remained bullish, stating, “Bitcoin is always a good investment,” provided investors are prepared for volatility and hold a time horizon of at least four years.

He compared BTC’s performance to traditional assets, noting that bitcoin has averaged roughly 50% annual growth over the past five years, outperforming gold and the S&P.

He also contrasted investment approaches, suggesting that those seeking exposure to digital credit instruments might prefer other products, while investors aiming for long-term ownership of “digital capital” should focus on bitcoin.

Even as market jitters continue and institutional outflows impact prices, Strategy is doubling down. “We’re always buying,” Saylor said, signaling that the firm intends to use market dips to expand its bitcoin holdings rather than sell.

Saylor: Trillions in Bitcoin

In a wide-ranging interview with Bitcoin Magazine earlier this year, Saylor outlined an ambitious vision to build a trillion-dollar Bitcoin balance sheet, using it as a foundation to reshape global finance.

He envisions accumulating $1 trillion in Bitcoin and growing it 20–30% annually, leveraging long-term appreciation to create a massive store of digital collateral.

From this base, Saylor plans to issue Bitcoin-backed credit at yields significantly higher than traditional fiat systems, potentially 2–4% above corporate or sovereign debt, offering safer, over-collateralized alternatives.

He anticipates this could revitalize credit markets, equity indexes, and corporate balance sheets while creating new financial products, including higher-yield savings accounts, money market funds, and insurance services denominated in Bitcoin.

Earlier this week, Strategy bought 487 BTC for about $49.9 million. At the time of announcement, Bitcoin’s price was near $106,000. The purchases, made between November 3 and 9 at an average of $102,557 per BTC, bring Strategy’s total holdings to 641,692 BTC, acquired for roughly $47.54 billion at an average price of $74,079 each, underscoring the company’s ongoing commitment to its Bitcoin treasury strategy.

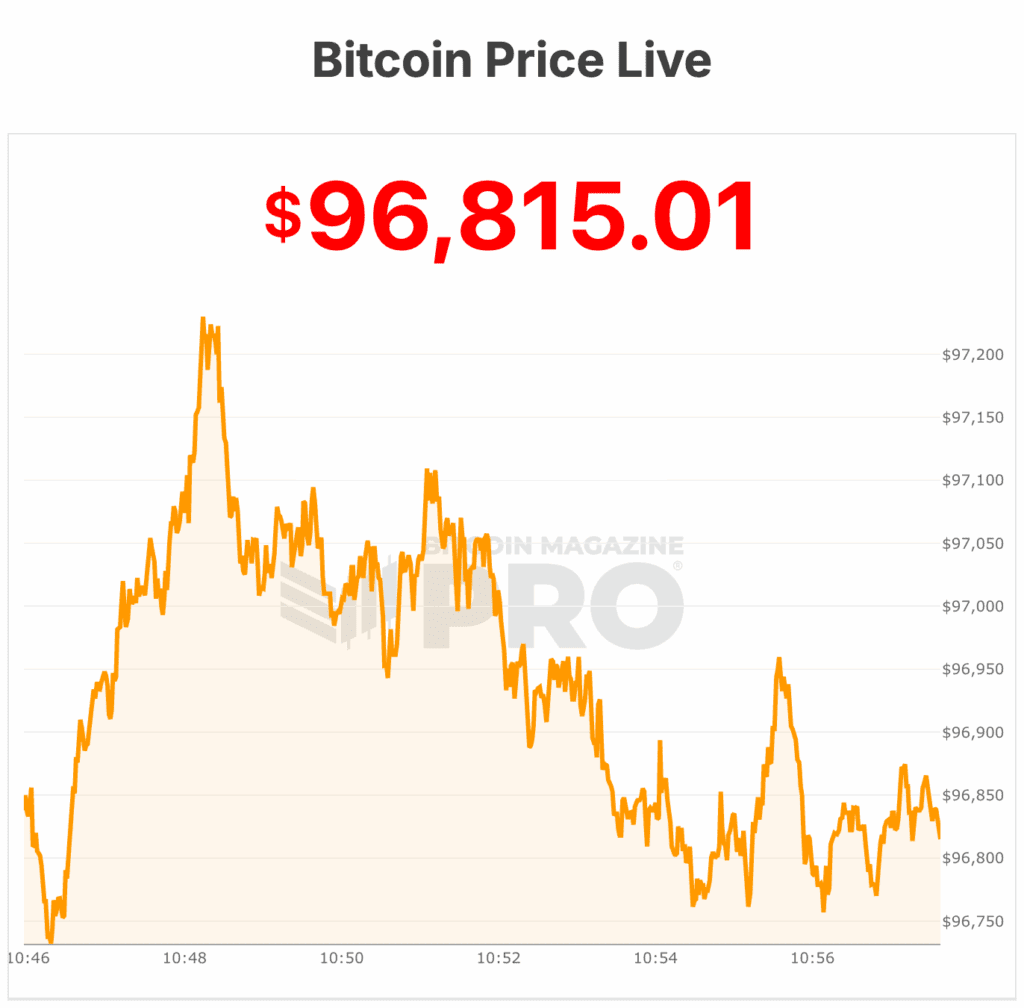

At the time of writing, Bitcoin is trading at $96,815, with lows recorded near $94,000.